One thing that can be challenging about marketing attribution is not know what is “normal” and what could be optimized. I’ve talked about the customer “journey/path” and marketing attribution a bit in the past. While no business is exactly the same, there’s always something to learn when you stack up your business next to others in the same industry or of the same size, etc.

Google’s Think program just came out with a new tool – The Customer Journey to Online Purchase. This tool shows on average, how and when marketing channels affect the purchase decisions for different size businesses across industries.

The main thing to use this tool for is to get an idea of how you can improve your business. If your business is new and growing and you don’t even have a customer journey yet, having a framework like this to look at will give you a place to start in where marketing channels usually fit in the purchase process.

The tool allows you to explore based on business size (small is defined as < 500 ecommerce transactions in 45 days; medium is 500-10,000; large is > 10,000). The data is organized into 19 industry categories, including: arts & entertainment, autos & vehicles, beauty & fitness, books & literature, business & industrial, computers & electronics, finance, food & drink, games, hobbies & leisure, home & garden, internet & telecom, jobs & education, law & government, people & society, pets & animals, shopping, sports, and travel. Country-wise, the tool includes: Australia, Brazil, Canada, France, Germany, Japan, UK, and USA.

Keep in mind that this tool is an experiment and useful, but maybe not the godsend of exact data and information for your business. For example, the industry categories are broad (shopping? business and industrial?). Size is also based on transactions – what if you have less than 500 transactions that are worth $2,000 each? And cross-device activity is not reported in Google’s Think reports. So take a look at the tool, and now we’ll go over two main ideas: first, how different marketing channels influence the purchase decision and then the channels position on the path to purchase.

How marketing channels influence the purchase decision: by size, industry, and country

Taking a look at the first part of the tool, select your business size, industry, and country. Here’s a look at small businesses in the travel industry in the USA:

More often an assist interaction at the beginning of the customer purchase journey will be organic search. This is where marketing channels like your blog – having quality and interesting content and being SEO-friendly is important to bringing potential customers in. Next is referrals, generic paid search, brand paid search. Maybe they’ll come back to you based on a retargeting campaign, or they come in via another website or blog, or you’re familiar enough that they’ll search for you by name. At this point, they’re hopefully interested enough in you and trust you that they want to hear more from you and they invite you into their inbox (how nice!). Then, it looks like your email newsletter is closer to the end of the journey and is more often one of the last interactions. So they’re getting your newsletter, they visit your site sometimes through the newsletter and sometimes just directly. One day, they purchase! Rinse. Repeat.

If you have a general idea of how your customer journey looks — you have a better understanding of how to communicate and what to say, when!

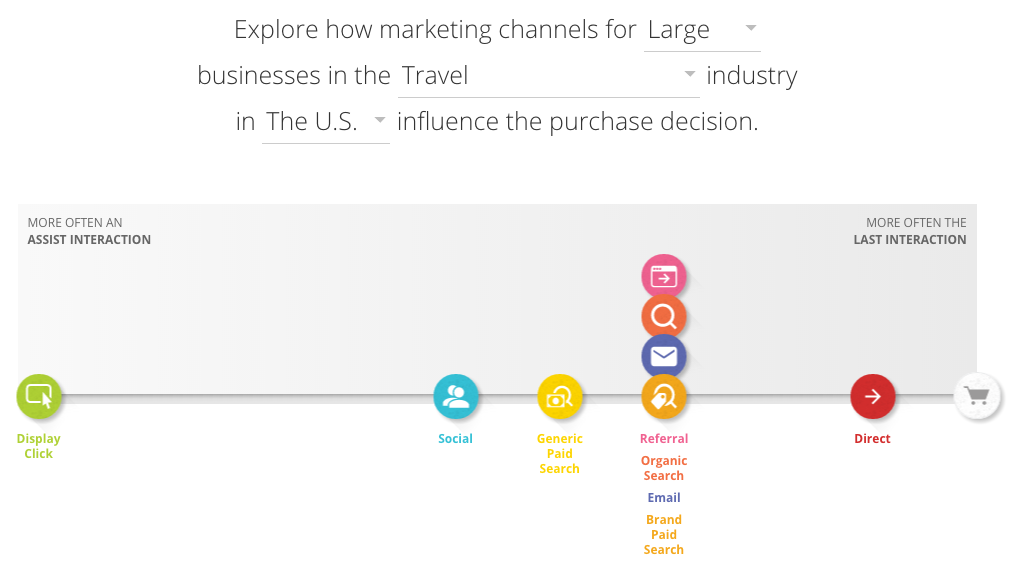

Now let’s explore marketing channels for large businesses, while keeping the industry as travel, and the country as US:

This time, the journey begins with display clicks > social > generic paid search > ref/organic/email/brand paid search > direct. Things are looking a little different. Paid search tends to be a much bigger part of early acquisition. Social plays a bigger part in keeping new fans engaged while they become familiar, and then the usual suspects of referral, organic, email and more paid search come into play.

So take a few minutes and check out the tool for your business. Find the closest matching customer journey example and compare it to what you know about your business.

Takeaway Questions:

- How is the sample purchase path similar to yours?

- How is it different?

- How might your customer purchase path change as your company grows from a small to medium?

- Are there any marketing channels that you’re not currently using that might help grow your business?

- What channels are more about growing awareness versus closing sales?

- Given your second and third largest countries for your customer base, how do different countries compare using the tool, if you leave size and industry the same?

The attribution model comparison tool in Google Analytics can help us see whether our different marketing channels live closer to the beginning or end of the path.

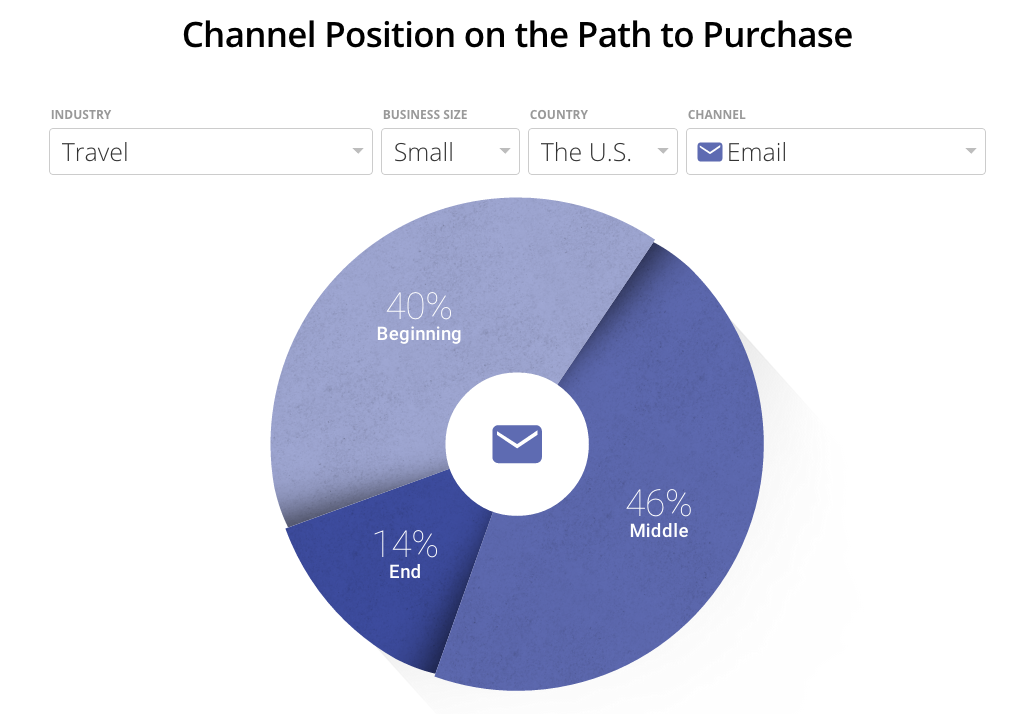

Channel Position on the Path to Purchase

Your email campaign may have a different impact on your customers depending on when they interact with it. At the beginning of the purchase path, email helps customers gain awareness of your product or service. In the middle, it creates desire and boosts interest. And at the end, it helps to seal the deal.

Take a look at the second part of the Google Think tool. This time you can filter based on the channel to compare beginning, middle, and end positioning:

Think about how your email campaigns differ based on where your customer is in their journey. If 40% of the people reading your email newsletter are at the beginning of the purchase path, what is your goal? Perhaps to educate, raise awareness of what you do/offer, build trust etc. If 46% of people reading are in the middle of their purchase path what is your goal? Perhaps to create interest, desire, educate, and continue building trust. If 14% of people reading are at the end, what is your goal? Probably to close the sale – while not annoying them.

Now, as you know an email campaign is not just a static bulk “blast” from me to 10,000 people. We now have the ability to communicate differently to those at the beginning, middle, and end of journey.

Takeaway Questions:

- What percentage of beginning, middle, end most closely resembles your business?

- This tool doesn’t address time to purchase. Some people will whip through your customer journey in 2 days, others will mosey along for 2 months. What does your time to purchase look like?

- How can being aware of where the customer is most typically at impact your day to day work and overall strategy in specific marketing channels? Maybe you could test out paid search or an educational drip campaign to new users etc.

Remember, Google’s Think data was taken from analyzing millions of consumers across industries and channels. It’s still nothing on the data you have about your particular business. If your business works differently, don’t think it needs to be like the average, but see if you can learn anything.